The Role Of Property Investment In A Diversified Portfolio

October 5, 2023 | by Catherine Jones

Are you looking to diversify your investment portfolio and generate passive income? Look no further than property investment. In this article, we will explore the crucial role that property investment plays in creating a diversified portfolio. As an expert in the property investment world, you understand the potential of using property as a means to hedge against inflation and generate steady income. Join us as we delve into the benefits of incorporating property into your investment strategy and discover how it can contribute to a diversified and resilient portfolio.

Why diversify your investment portfolio?

When it comes to investing, diversification is a key strategy that can help you minimize risk and maximize returns. By spreading your investments across different asset classes, you can reduce the impact of any single investment’s performance on your overall portfolio. Diversification allows you to take advantage of various market conditions and lessen the chance of losing your entire investment if one asset class performs poorly.

Benefits of diversification

Diversification offers several benefits for investors. Firstly, it can potentially increase returns by giving you exposure to multiple investment opportunities. Different asset classes tend to perform differently over time, so by diversifying, you can capitalize on those variances and potentially achieve a higher overall return.

Secondly, diversification helps to reduce the overall risk of your investment portfolio. By not putting all your eggs in one basket, you are less susceptible to the downfall of a single investment or asset class. If one investment underperforms or experiences a downturn, other investments in your portfolio can help offset those losses.

Lastly, diversification can enhance the stability of your portfolio. By combining assets with varying levels of risk and return, you can create a more balanced and resilient investment strategy. This stability can provide you with peace of mind and reduce the anxiety that often accompanies investing.

Reducing risk through diversification

One of the main reasons investors diversify their portfolios is to reduce risk. When you spread your investments across different asset classes, you minimize the potential impact of any single investment’s performance on your overall portfolio.

For example, imagine you have invested all your money in a single stock. If that stock performs poorly, your entire investment will suffer. However, if you had diversified your portfolio and invested in a mix of stocks, bonds, real estate, and other assets, the poor performance of one investment would have a smaller impact on your overall portfolio.

By diversifying, you can hedge against the risk of individual investments and potentially protect your capital from significant losses. This risk reduction is one of the primary reasons why diversification is considered a fundamental principle of investing.

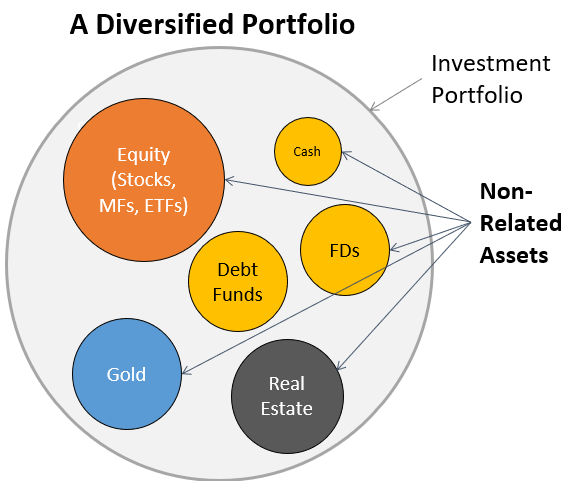

Different asset classes for diversification

To effectively diversify your investment portfolio, it is essential to consider different asset classes. The following are some common asset classes that can be included in a diversified portfolio:

-

Stocks and bonds: Stocks represent ownership in companies, while bonds are debt instruments issued by governments or corporations. Combining both stocks and bonds in your portfolio can offer a balance between potential growth and income generation.

-

Commodities: Commodities, such as gold, silver, oil, and agricultural products, can act as a hedge against inflation. Including commodities in your portfolio can provide diversification and protection against economic downturns.

-

Mutual funds: Mutual funds pool money from multiple investors and invest in a diversified portfolio of stocks, bonds, or other assets. Investing in mutual funds allows you to gain exposure to a broad range of securities without needing to directly purchase individual stocks or bonds.

-

Exchange-traded funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges. They offer diversification by tracking an index or a specific sector, allowing investors to gain exposure to multiple stocks or bonds with a single investment.

-

Real estate investment trusts (REITs): REITs are companies that own, operate, or finance income-generating real estate properties. investing in REITs can provide diversification in the real estate sector without the need for direct property ownership.

-

Cryptocurrencies: Cryptocurrencies, such as Bitcoin and Ethereum, have gained popularity as alternative investments. Although they are highly volatile, including a small portion of cryptocurrencies in your portfolio can add diversification and potential for high returns.

By diversifying across these asset classes, you can minimize the risk associated with any single investment or sector and potentially achieve a more stable and profitable portfolio. However, it’s crucial to conduct thorough research and consult with a financial advisor before investing in these assets to understand their specific risks and suitability for your investment goals.

Understanding property investment

Definition of property investment

Property investment refers to the purchase, ownership, or management of real estate with the primary aim of generating income and capital appreciation. It involves putting money into properties such as residential homes, commercial buildings, or vacant land, with the expectation of earning a return on investment.

Investing in properties can be done directly by purchasing the property outright or indirectly through real estate investment trusts (REITs) or real estate mutual funds. Property investment offers investors the opportunity to generate passive income by renting out properties or receiving regular dividends from REITs while also benefiting from the potential increase in property value over time.

Types of property investments

Property investments encompass various types of real estate assets. Some common types of property investments include:

-

Residential properties: These include single-family homes, apartments, townhouses, or condominiums. Residential properties are popular among investors looking for a steady stream of rental income and potential long-term appreciation.

-

Commercial properties: Commercial properties encompass office buildings, retail spaces, industrial warehouses, and shopping centers. Investing in commercial real estate can offer higher rental yields and potential significant returns, but it often requires more knowledge and experience to manage.

-

Vacation rentals: Vacation rentals, such as Airbnb properties, have gained popularity in recent years. Investors can purchase properties in tourist destinations and rent them out to vacationers as a short-term accommodation option. This type of investment can provide higher rental income during peak tourist seasons.

-

Real estate development: Real estate development involves purchasing land or existing properties with the intent of improving or developing them for financial gain. This may include constructing new buildings, renovating existing properties, or converting non-residential properties into residential units.

-

Real estate investment trusts (REITs): REITs are publicly traded companies that own, operate, or finance income-generating properties. By investing in REITs, individuals can gain exposure to the real estate market without directly owning properties. REITs offer the potential for regular dividends and liquidity through stock market trading.

Advantages of property investment

Property investment offers several advantages that make it an attractive option for investors seeking both income and long-term growth:

-

Income generation: One of the primary benefits of property investment is the potential for regular rental income. By renting out properties, investors can generate passive income that can help cover mortgage payments, maintenance costs, and even provide a steady stream of cash flow.

-

Capital appreciation: Property values have historically tended to increase over time, providing investors with the opportunity for capital appreciation. As demand for real estate grows and supply becomes limited, property prices can rise, resulting in potential profits if the property is sold at a higher value than its purchase price.

-

Inflation hedging: Real estate investments are often considered a hedge against inflation. As the cost of living increases, rental income and property values tend to rise as well, keeping pace with inflation and preserving the investor’s purchasing power.

-

Diversification: Property investment allows investors to diversify their portfolios by adding an alternative asset class. Real estate’s performance is generally not closely correlated with other asset classes like stocks and bonds, providing additional stability and potential returns during economic downturns.

-

Tangible asset: Unlike stocks or bonds, real estate represents a physical asset that investors can see and touch. This tangibility can provide a sense of security and reassurance, especially for those who prefer investing in assets they can physically monitor and control.

-

Tax benefits: Property investment offers various tax advantages, such as deductible expenses like mortgage interest, property taxes, and depreciation. These tax benefits can help offset the costs associated with property ownership and potentially increase the overall return on investment.

Risks associated with property investment

While property investment can be lucrative, it is not without risks. It is important to be aware of the potential challenges and downside risks associated with investing in real estate. Some of the key risks include:

-

Market volatility: Property values can fluctuate based on supply and demand dynamics, economic conditions, and changes in interest rates. Economic downturns or shifts in market trends can result in decreased property values and rental income.

-

Economic factors: Factors like unemployment rates, interest rates, and GDP growth can impact the demand and profitability of real estate investments. Economic recessions or slowdowns can lead to reduced demand for rental properties and financial hardships for tenants, affecting rental income and property values.

-

Financing and liquidity risks: Obtaining financing for property investments can be challenging, especially during economic downturns or credit market contractions. Additionally, real estate investments may not have the same level of liquidity as stocks or bonds, making it difficult to sell properties quickly if needed.

-

Regulatory changes: Changes in government policies, zoning regulations, or tax laws can impact the profitability and feasibility of real estate investments. Investors should stay informed about potential regulatory changes that could affect their investment strategy and adjust their plans accordingly.

-

Physical property risks: Property investments come with risks associated with physical damage, maintenance, and liability. Costs related to repairs, insurance, property management, and legal disputes can reduce the overall profitability of the investment.

-

Tenant-related risks: Rental properties are subject to the risk of tenants failing to pay rent or causing damage to the property. Vacancy rates can also impact rental income, especially during economically challenging times or in locations with high competition.

It is important for property investors to conduct thorough due diligence, assess the potential risks, and develop effective risk management strategies to mitigate these challenges. Consulting with professionals, such as real estate agents, property managers, and financial advisors, can provide valuable guidance in navigating the risks associated with property investment.

The importance of diversifying property investments

Avoiding concentration risk

Diversifying property investments is crucial in order to avoid concentration risk. By allocating your investment capital across multiple properties, you spread the risk associated with individual properties. If you were to invest all your capital in a single property, any negative developments that affect that particular property, such as a decline in demand or legal issues, could significantly impact your overall investment performance. Diversification helps protect your investment by minimizing the impact of any single property’s performance on your portfolio.

Protecting against market fluctuations

Another key advantage of diversifying property investments is its ability to protect against market fluctuations. Real estate markets can experience periods of volatility, with property values and rental rates fluctuating. By diversifying your investments across different locations, property types, and market segments, you can reduce your vulnerability to market downturns. For example, if one market experiences a decline, investments in other markets may continue to perform well, helping to mitigate overall losses and maintain stability in your portfolio.

Achieving long-term growth

Diversifying property investments also enables you to achieve long-term growth. Different property types and locations have varying growth rates, influenced by factors such as population growth, economic development, and infrastructure projects. By diversifying across areas with different growth rates, you can maximize the potential for long-term appreciation. For instance, investing in rapidly developing regions or emerging markets may offer higher growth potential, while stable, mature markets may provide steady and reliable income.

Maximizing income potential

Diversification in property investments can also offer increased income potential. By investing in a mix of residential and commercial properties, you can tap into different rental markets and income streams. Residential properties generally provide stable, long-term rental income, while commercial properties, such as office spaces or retail shops, may offer higher rental yields. By balancing your portfolio with different property types, you can optimize your income potential and reduce the reliance on a single source of rental income.

By diversifying your property investments, you can minimize risks, protect against market fluctuations, achieve long-term growth, and maximize income potential. It is important to thoroughly research and assess each property investment opportunity, considering factors such as location, market dynamics, potential rental income, and demand. Engaging the services of professionals, such as real estate agents and property managers, can provide expertise and support in identifying attractive investment opportunities and managing the diversified portfolio effectively.

Exploring other investment options

While property investment offers several advantages, diversifying your portfolio further through other investment options can provide additional benefits and mitigate specific risks. Here are some alternative investment options to consider:

Stocks and bonds

Investing in stocks and bonds allows you to participate in the equity and fixed income markets. Stocks represent ownership in companies, while bonds are debt instruments issued by governments or corporations. By including stocks and bonds in your portfolio, you gain exposure to different companies and industries, which can provide diversification and potentially higher returns. Additionally, fixed income investments like bonds can offer stability and income generation.

Commodities

Commodities, such as gold, silver, oil, and agricultural products, can act as a hedge against inflation and provide diversification in a portfolio. These tangible assets often have limited supply and tend to perform differently from other investment assets like stocks and bonds. Including commodities in your portfolio can help mitigate risks associated with economic downturns or inflationary pressures.

Mutual funds

Mutual funds pool money from multiple investors and invest in a diversified portfolio of stocks, bonds, or other assets. They are managed by professional fund managers who make investment decisions on behalf of the investors. Investing in mutual funds allows you to gain exposure to a broad range of securities and diversify your investments without needing to directly purchase individual stocks or bonds. Mutual funds provide convenience, diversification, and the expertise of professional fund managers.

Exchange-traded funds (ETFs)

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They track specific indices, sectors, or asset classes, allowing investors to gain exposure to multiple stocks or bonds with a single investment. ETFs provide diversification, liquidity, and flexibility in managing investment portfolios. Additionally, they often have lower expense ratios compared to traditional mutual funds.

Real estate investment trusts (REITs)

REITs are publicly traded companies that own or finance income-generating real estate properties. By investing in REITs, individuals can gain exposure to the real estate market without the need for direct property ownership. REITs offer diversification in the real estate sector, regular dividend income, and the potential for capital appreciation. They are regulated entities required to distribute at least 90% of their taxable income to shareholders in the form of dividends.

Cryptocurrencies

Cryptocurrencies, such as Bitcoin and Ethereum, have gained popularity as alternative investments. These digital assets operate on blockchain technology and offer decentralized and secure transactions. While highly volatile and speculative, including a small portion of cryptocurrencies in your portfolio can provide diversification and potential high returns. It is important to conduct thorough research, understand the risks associated with these assets, and consider compliance with regulatory requirements.

By exploring these investment options, you can further diversify your portfolio beyond property investments. However, it is crucial to assess the risks, conduct thorough research, and consider your investment goals, risk tolerance, and time horizon before allocating funds to these alternative assets. Consulting with a financial advisor or investment professional can provide valuable insights and help you make informed decisions.

Key considerations for property investors

Successful property investment requires careful consideration of various factors and diligent decision-making. Here are some key considerations for property investors:

Location selection

The location of a property plays a crucial role in its investment potential. Consider factors such as proximity to amenities, transportation links, schools, and job opportunities. Properties in highly desirable areas tend to experience higher demand and potential appreciation. Research the local market dynamics, growth prospects, and economic indicators to identify locations with excellent investment potential.

Market analysis

Conduct a thorough market analysis to understand the current and future supply and demand dynamics. Evaluate trends in property prices, rental rates, vacancy rates, and absorption rates in the specific market you are considering. Analyze economic indicators, population growth, and infrastructure developments that can impact the long-term performance of the property.

Property management

Managing a property effectively is essential for maximizing returns and minimizing risks. Decide whether you will manage the property yourself or hire a professional property management company. Property managers handle tasks such as tenant screening, rent collection, property maintenance, and legal compliance. Having an efficient property management system in place ensures smooth operations and enhances the overall investment experience.

Cash flow analysis

Conduct a detailed cash flow analysis to determine the expected income and expenses associated with the property. Consider factors like rental income, mortgage payments, property taxes, insurance, maintenance costs, and property management fees. Ensure that the potential rental income exceeds the expenses, allowing for positive cash flow. A thorough cash flow analysis helps assess the financial viability and profitability of the investment.

Risk management

Identify and assess risks associated with the property investment and develop strategies to manage them effectively. Consider risks such as property damage, insurance coverage, tenant default, and legal disputes. Diversifying your property portfolio and adequately insuring your assets are key risk management strategies in property investment.

Exit strategies

Plan and consider exit strategies before investing in a property. Determine the duration of your investment and the circumstances under which you may want to sell the property. Options may include selling the property when it appreciates significantly, refinancing to access equity for other investments, or holding it long-term for rental income. Knowing your exit strategy helps guide your investment decisions and ensures alignment with your financial goals.

Considering these key factors helps property investors make informed decisions, minimize risks, and maximize returns. Thorough research, due diligence, and consultation with professionals can provide valuable insights and support throughout the investment process.

Risks and challenges of property investment

Property investment, like any investment, comes with risks and challenges that investors must understand and manage. Here are some of the key risks and challenges associated with property investment:

Market volatility

Real estate markets can experience periods of volatility, with property values and rental rates fluctuating. Economic conditions, changes in interest rates, and shifts in demographic trends can impact property prices and rental demand. Investors need to be prepared for potential market downturns and have strategies in place to mitigate the associated risks.

Economic factors

Economic factors, such as GDP growth, employment rates, and interest rates, can significantly influence the performance of property investments. Economic recessions or slowdowns can lead to reduced demand for rental properties and financial hardships for tenants. Investors should monitor economic indicators and adapt their investment strategies to align with prevailing economic conditions.

Financing and liquidity risks

Obtaining financing for property investments can be challenging, especially during economic downturns or in situations where lenders tighten credit requirements. Investors may face difficulty securing mortgages or refinancing existing loans, which can impact their ability to acquire or maintain properties. Additionally, real estate investments often lack the same level of liquidity as stocks or bonds, making it difficult to sell properties quickly when needed.

Regulatory changes

Changes in government policies, zoning regulations, or tax laws can significantly impact the profitability and feasibility of property investments. Investors need to stay informed about potential regulatory changes that could affect their investment strategy and adjust their plans accordingly. Unexpected policy shifts can result in increased costs, reduced rental income, or changes in property valuations.

Physical property risks

Physical property risks include potential damage due to natural disasters, accidents, or wear and tear. Costs associated with repairs, renovation, and maintenance can impact the overall profitability of the investment. Investors should budget for maintenance expenses and consider insurance coverage to mitigate the financial impact of physical property risks.

Tenant-related risks

Property investments that rely on rental income are subject to the risk of tenants failing to pay rent, causing damage to the property, or being difficult to manage. High vacancy rates can also impact rental income, particularly in markets with oversupply or during economic downturns. Thorough tenant screening, effective property management, and lease agreements can help mitigate tenant-related risks.

To mitigate these risks and challenges, property investors should conduct thorough due diligence, formulate risk management strategies, and keep themselves informed about market conditions and legal requirements. Engaging the services of professionals, such as real estate agents, property managers, and legal advisors, can provide valuable expertise and support in navigating these risks.

Strategies for building a diversified property portfolio

Building a diversified property portfolio involves selecting properties that offer a mix of different characteristics and investment opportunities. By diversifying your property investments, you can spread your risk and increase the potential for long-term returns. Here are some strategies for building a diversified property portfolio:

Investing in different property types

Invest in a variety of property types, such as residential, commercial, and vacation rentals. Each property type carries its own potential risks and rewards, and diversifying across property types allows you to tap into different market segments and income streams. Residential properties generally offer stable, consistent rental income, while commercial properties may provide higher rental yields and potential capital appreciation.

Geographic diversification

Invest in properties located in different regions or cities to spread your risk across multiple markets. Economic conditions, population growth, and infrastructure developments can vary significantly across locations, leading to different investment opportunities and potential returns. Geographic diversification helps protect your portfolio from localized market downturns and may enable you to benefit from the growth of different regions.

Investing across various price ranges

Consider investing in properties across various price ranges. Diversifying across different price points allows you to access different rental markets and cater to a wider range of tenants. Lower-priced properties may provide higher rental yields but lower capital appreciation, while higher-priced properties may offer lower rental yields but higher potential for long-term growth.

Mixing residential and commercial properties

Investing in a mix of residential and commercial properties can provide diversification within the real estate sector. Residential properties tend to offer stable, long-term rental income, while commercial properties may have higher rental yields and the potential for increased returns. Balancing the investment portfolio with both residential and commercial properties can help mitigate risks associated with a single property type or market segment.

Consideration of property cycles

Property markets go through cycles of expansion, contraction, and stabilization. Understanding the property market cycles and investing accordingly can help maximize returns and reduce risks. When a market is in a downturn or stabilization phase, it may present opportunities for value investments and potential appreciation in the future. Conversely, during a period of market expansion, investments focused on income generation and rental stability may be more favorable.

By incorporating these strategies, you can build a diversified property portfolio that leverages different property types, geographic locations, price ranges, and market cycles. Diversification helps reduce risks, optimize income potential, and position your portfolio for long-term growth.

Benefits of property investment in a diversified portfolio

Including property investments in a diversified portfolio offers several benefits, making it an attractive option for investors seeking a balanced and resilient investment strategy. Here are some key benefits of property investment in a diversified portfolio:

Stable income generation

Property investments can provide stable and consistent rental income, especially when properties are properly managed and located in high-demand areas. Rental income can serve as a reliable source of cash flow, helping cover expenses, repay mortgages, and generate additional income. Property investments often have higher and more predictable yields compared to other asset classes like stocks and bonds, contributing to the stability of the overall investment portfolio.

Inflation hedging

Property investments are often considered a hedge against inflation. As the cost of living increases, rental income and property values tend to rise as well, helping to preserve the investor’s purchasing power. Real estate investments offer a tangible asset that can appreciate in value over time and serve as a store of wealth in inflationary environments. Including property investments in a diversified portfolio can provide protection against the erosion of wealth caused by inflation.

Portfolio risk reduction

Diversification through property investments reduces the overall risk of a portfolio. By including real estate alongside other asset classes like stocks, bonds, and commodities, investors can minimize the impact of any single investment’s performance on the overall portfolio. The lower correlation between property investments and other asset classes allows for risk reduction and potentially higher risk-adjusted returns. Property investments often exhibit low volatility, offering stability and insulation during market downturns.

Potential for capital appreciation

Property investments have the potential for long-term capital appreciation. While there can be short-term fluctuations in property values, real estate tends to appreciate in value over the long term. Population growth, urbanization, and limited land supply all contribute to the potential for increased property values. Owning properties in appreciating markets can provide investors with the opportunity to benefit from capital gains when they decide to sell or refinance the property.

By including property investments in a diversified portfolio, investors can benefit from stable income generation, inflation hedging, risk reduction, and potential capital appreciation. The combination of these advantages contributes to the overall performance and resilience of the investment portfolio.

Case studies: Successful diversified property portfolios

To illustrate the benefits of a diversified property portfolio, let’s explore three case studies showcasing different strategies:

Portfolio 1: Balancing residential and commercial properties

In this portfolio, the investor holds both residential and commercial properties in a mix of locations. The residential properties provide a stable income stream, while the commercial properties offer higher rental yields. By diversifying across property types, the investor benefits from both steady income and potential long-term growth. The residential properties help offset any fluctuations in the commercial rental market, ensuring a consistent cash flow.

Portfolio 2: Geographic diversification for steady growth

This portfolio focuses on geographic diversification, with properties located in different regions that exhibit stable growth prospects. By investing in markets with diverse economic conditions, the investor mitigates risks associated with localized market downturns. The portfolio includes properties in both urban and suburban areas, targeting both rental income and potential appreciation. This strategy aims to provide steady growth over the long term.

Portfolio 3: Investing in different property types for income diversity

In this portfolio, the investor diversifies across different property types to maximize income diversity. Residential properties provide a steady rental income, while vacation rentals generate higher rental yields during peak tourist seasons. The investor has also incorporated commercial properties to enhance income potential further. By combining different property types, the portfolio achieves a balanced mix of reliable income and growth potential.

These case studies highlight the advantages of diversifying property investments and tailoring the portfolio to specific investment goals, risk tolerance, and market conditions. Investing in a mix of residential and commercial properties, pursuing geographic diversification, and diversifying across property types can help investors build successful and resilient portfolios.

Conclusion

In conclusion, property investment can play a vital role in a diversified portfolio, offering stability, income generation, and long-term growth potential. By diversifying across different property types, locations, and market segments, investors reduce risk, protect against market fluctuations, and optimize returns. Property investments provide stable and predictable rental income, act as a hedge against inflation, and offer the potential for capital appreciation.

When building a diversified property portfolio, investors should consider factors such as location selection, market analysis, property management, cash flow analysis, risk management, and exit strategies. Thorough research, due diligence, and consultation with professionals are essential for making informed investment decisions and managing the associated risks.

By incorporating property investments alongside other asset classes like stocks, bonds, and commodities, investors can create a balanced and resilient investment portfolio. Ongoing monitoring and adjustment of the portfolio are crucial to ensure alignment with investment goals and changing market conditions. Property investment, when approached strategically and diversely, can contribute significantly to long-term financial success and wealth accumulation.

RELATED POSTS

View all