Thinking about investing in vacation rentals? This article will give you a comprehensive overview of the pros and cons involved. As someone knowledgeable in the world of property investment, you understand the value of utilizing property to generate passive income and protect against inflation. We’ll take a deep dive into the advantages and disadvantages of investing in vacation rentals, providing you with valuable insights to help you make an informed decision. With a minimum of 3000 words, this skyscraper format article will cover everything you need to know, from H1 to H3 tags. So, let’s explore the exciting world of investing in vacation rentals and uncover the potential opportunities and challenges it presents.

Pros of Investing in Vacation Rentals

High income potential

Investing in vacation rentals can offer a high income potential. With the growing popularity of vacation rentals, especially through platforms like Airbnb and VRBO, you have the opportunity to generate significant rental income. By renting out your property to vacationers, you can earn a substantial amount of money, especially during peak travel seasons or in highly sought-after vacation destinations.

Flexibility in use

One of the key advantages of investing in vacation rentals is the flexibility it provides. You have the freedom to use the property for personal vacations whenever you desire and then rent it out when you are not using it. This flexibility allows you to enjoy the benefits of a vacation home while also making it a lucrative investment.

Tax benefits

Investing in vacation rentals can also offer attractive tax benefits. Depending on your location and local tax laws, you may be able to deduct certain expenses related to your rental property, such as property taxes, insurance premiums, maintenance costs, and even mortgage interest. These deductions can significantly reduce your taxable rental income and provide you with additional financial advantages.

Appreciation potential

Real estate properties, including vacation rentals, have the potential to appreciate in value over time. As demand for vacation properties increases, especially in desirable locations, the value of your investment can grow significantly. This appreciation potential can provide you with long-term financial gains, making vacation rentals a smart investment choice.

Personal use

Unlike traditional rental properties, investing in vacation rentals allows you to enjoy the property yourself for personal vacations. You can have the best of both worlds, using your property as a vacation retreat for yourself, family, and friends, while also earning rental income from it. This personal use aspect adds a unique benefit to investing in vacation rentals and enhances your overall investment experience.

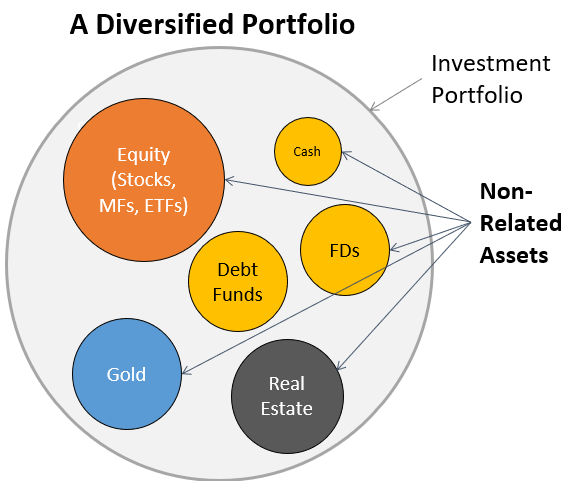

Diversification of income

Investing in vacation rentals can provide you with diversification of income. By having a rental property, you are not solely dependent on one source of income like a job or a single investment. The rental income from vacation rentals can serve as an additional stream of revenue, bringing in extra cash flow and helping you diversify your overall income portfolio.

Opportunity for long-term growth

Vacation rentals have the potential for long-term growth. As the travel and tourism industry continues to expand, more people are opting for vacation rentals instead of traditional hotels. This trend indicates a sustained demand for vacation rental properties, which can lead to long-term growth and increased profitability for investors.

Demand for vacation rentals

The demand for vacation rentals is consistently high, making it an attractive investment opportunity. Travelers often prefer the comfort and privacy of a vacation rental over a hotel, especially for family vacations or group trips. By investing in vacation rentals, you can tap into this growing demand and secure a steady flow of renters, increasing your rental income potential.

Ability to generate passive income

Investing in vacation rentals offers the opportunity to generate passive income. Once you have set up and furnished your rental property, the income can flow in without requiring significant effort on your part, especially if you hire a property management company to handle bookings, guest communications, and property maintenance. This passive income stream can provide financial stability and freedom.

Opportunity for rental income increase

As your vacation rental gains popularity and positive reviews, you can increase your rental rates, resulting in higher rental income. By continuously improving and upgrading your property, providing excellent customer service, and marketing your rental effectively, you can attract more guests and command higher prices. This opportunity for rental income increase is a significant advantage of investing in vacation rentals.

Cons of Investing in Vacation Rentals

High upfront costs

Investing in vacation rentals typically involves high upfront costs. Purchasing a property, furnishing it, and setting it up as a vacation rental can require a substantial initial investment. You need to consider factors like down payments, closing costs, property taxes, insurance, and renovation expenses. These upfront costs can be a barrier for some investors.

Seasonal demand

Vacation rentals often experience seasonal demand, meaning that bookings may be higher during peak travel seasons or popular vacation periods and slower during off-peak times. This seasonal fluctuation in demand can result in inconsistent rental income, requiring careful financial planning to ensure a steady cash flow throughout the year.

Management and maintenance responsibilities

Investing in vacation rentals comes with management and maintenance responsibilities. As a property owner, you will need to handle tasks such as guest bookings, check-ins and check-outs, cleaning and maintenance, and responding to guest inquiries and concerns. While you can hire a property management company to handle these responsibilities, it comes at an additional cost that may impact your overall profitability.

Competition from other vacation rentals

The vacation rental market is becoming increasingly competitive, with more individuals and investors recognizing its potential. This means that you will face competition from other vacation rentals in your area, especially in popular tourist destinations. To succeed, you need to offer a unique and appealing rental property, provide exceptional guest experiences, and stay up-to-date with industry trends.

Location-specific risks

Investing in vacation rentals also comes with location-specific risks. Depending on where your property is located, you may face risks such as natural disasters, extreme weather conditions, or economic downturns that can impact travel and tourism. It is essential to consider these risks and ensure you have proper insurance coverage to protect your investment.

Regulations and legal considerations

Vacation rentals are subject to various regulations and legal considerations. Some cities or municipalities may have specific rules and restrictions on short-term rentals, including licensing requirements, occupancy limits, zoning regulations, and tax obligations. It is crucial to familiarize yourself with these regulations and ensure compliance to avoid potential fines or legal issues.

Potential for rental income fluctuations

While vacation rentals have the potential for high income, there is also the potential for rental income fluctuations. Factors such as changes in travel patterns, economic downturns, or increased competition can impact your rental income. It is important to have a financial cushion to mitigate these fluctuations and plan for potential income dips.

Risks of damage and liability

Renting out your property as a vacation rental exposes you to the risks of damage and liability. Guests may cause accidental damage to the property, resulting in repair costs. Additionally, you may be held liable for injuries or accidents that occur on your rental property. Adequate insurance coverage is crucial to protect yourself from these risks.

Dependency on tourism industry

Investing in vacation rentals means having a degree of dependency on the tourism industry. The success of your rental property is closely tied to the demand for travel and tourism in your specific location. Economic downturns, changes in travel patterns, or unforeseen events like pandemics can significantly impact the demand for vacation rentals, potentially affecting your rental income.

Need for continual marketing effort

To ensure a steady flow of bookings and maximize rental income, investing in vacation rentals requires ongoing marketing efforts. You need to actively promote your property, optimize listing descriptions and photos, and engage with potential guests through various marketing channels. This continual marketing effort can be time-consuming and may require additional financial investment.

In conclusion, investing in vacation rentals offers numerous advantages such as high income potential, flexibility in use, tax benefits, appreciation potential, and diversification of income. Additionally, vacation rentals provide opportunities for long-term growth, the ability to generate passive income, and the possibility of rental income increase. However, it is important to consider the cons, including high upfront costs, seasonal demand, management and maintenance responsibilities, competition from other vacation rentals, location-specific risks, regulations and legal considerations, potential for rental income fluctuations, risks of damage and liability, dependency on the tourism industry, and the need for continual marketing effort. By carefully weighing these pros and cons, you can make an informed decision about whether investing in vacation rentals aligns with your financial goals and risk tolerance.

RELATED POSTS

View all