How Do I Diversify My Investment Property Portfolio For Stability?

October 18, 2023 | by Catherine Jones

Looking to diversify your investment property portfolio for greater stability? In this article, we’ll explore strategies and tips to help you achieve just that. By spreading your investments across various properties and asset types, you can minimize risk and maximize your chances for long-term success. Whether you’re a seasoned pro or just starting out in the world of real estate investment, these insights will provide valuable guidance. So let’s dive in and discover how you can build a solid, diversified portfolio for stability and financial growth.

Diversifying Investment Property Portfolio

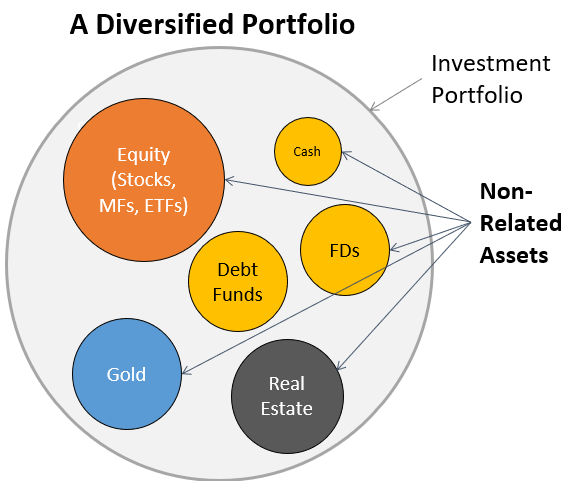

As an investor, it is crucial to understand the importance of diversifying your investment property portfolio. Diversification is a strategy that involves spreading your investments across different types of properties, locations, and market cycles. By doing so, you can mitigate risks and increase the stability of your portfolio. In this article, we will explore various factors to consider when diversifying your investment property portfolio, including residential and commercial properties, geographical diversification, different property types, rental property diversification, investment strategies, alternative real estate investments, retirement account investments, and the importance of seeking professional guidance.

Understanding the Importance of Diversification

Diversification is a concept that many investors are familiar with, and it holds true for investment property portfolios as well. By diversifying your investments, you are spreading your risk across different assets, which reduces the impact of any single property or market downturn. This helps to safeguard your portfolio from significant losses and maintain stability over the long term.

Benefits of a Diversified Investment Property Portfolio

A diversified investment property portfolio offers several benefits. Firstly, it helps to reduce the risk associated with any single property or market. If one property underperforms, the others in your portfolio can offset the losses, ensuring a more stable income stream. Secondly, diversification allows you to tap into different real estate markets, capturing the potential for growth in various locations. Additionally, a diversified portfolio can provide a hedge against inflation and economic uncertainties, as different property types and locations may respond differently to changing market conditions.

Factors to Consider for Diversification

When diversifying your investment property portfolio, there are several factors to consider. Let’s explore each of them in detail.

1. Residential Properties

Residential properties are a popular choice for many real estate investors. They offer a steady stream of income through rental payments and have the potential for long-term appreciation. Within the residential sector, there are several options to consider.

Investing in Single-Family Homes

Single-family homes are a common investment property choice. They are relatively easy to manage and attract a wide pool of potential tenants. Single-family homes also offer the flexibility to sell, rent, or hold the property for long-term appreciation.

Exploring Condominiums and Townhouses

Condominiums and townhouses can be attractive investment options, especially in urban areas. They typically offer amenities and shared common spaces, making them appealing to tenants. However, it’s important to carefully consider homeowner association fees and regulations before investing in this property type.

Benefits of Multi-Family Properties

Investing in multi-family properties, such as duplexes or apartment buildings, can provide multiple income streams from different units. This diversification of income reduces the risk associated with vacancies, as even if one unit is vacant, you still have other units generating rental income.

2. Commercial Properties

Commercial properties offer investors the opportunity to generate higher rental income compared to residential properties. They can be a valuable addition to a diversified investment property portfolio.

Types of Commercial Properties

Commercial properties encompass a wide range of asset classes, including office spaces, retail properties, and industrial properties. Each property type has its own unique characteristics and considerations.

Office Spaces for Stable Returns

Investing in office spaces can provide stable rental returns, especially in established business districts. However, it’s crucial to assess the demand and supply dynamics in the specific location before investing in this property type.

Retail Properties for Diversification

Retail properties, such as strip malls or standalone stores, offer the opportunity to diversify your investment property portfolio. It’s important to consider factors such as location, foot traffic, and the mix of tenants when evaluating retail properties.

Industrial Properties for Long-Term Stability

Investing in industrial properties, such as warehouses or distribution centers, can offer long-term stability and attractive rental yields. Industrial properties have seen increased demand in recent years due to the growth of e-commerce, making them an appealing option for diversification.

3. Geographical Diversification

Geographical diversification is another crucial aspect to consider when diversifying your investment property portfolio. Investing in properties across different cities or even exploring international real estate opportunities can provide exposure to different markets and reduce the risk associated with a single location.

The Importance of Geography in Diversifying Investment Property Portfolio

Investing solely in one city or region exposes your portfolio to the risks associated with that specific market. By diversifying across different geographical locations, you can capitalize on the growth potential of multiple markets and avoid concentration risk.

Investing Across Different Cities

Investing in properties across different cities allows you to take advantage of varying market conditions. You can choose cities with strong job growth, population growth, and favorable economic indicators to maximize the potential returns of your investment property portfolio.

Exploring International Real Estate Opportunities

For diversification on a global scale, exploring international real estate opportunities can be beneficial. Different countries present unique investment opportunities, and investing internationally can provide exposure to markets with potentially higher growth rates or lower investment costs. However, it’s critical to research and understand the legal and regulatory frameworks of the target country before investing.

4. Property Types and Market Cycles

Understanding market cycles and investing in different property types can further diversify your investment property portfolio.

Understanding Market Cycles

Real estate markets go through cycles of expansion, peak, contraction, and trough. By understanding these cycles and investing strategically, you can potentially benefit from market upswings and shield your portfolio during downturns.

Investing in Different Property Types

Diversifying your investment property portfolio across different property types can help mitigate risks associated with specific sectors. For example, investing in both residential and commercial properties can provide a balance between stable rental income and the potential for higher returns.

Benefits of Contrarian Investing

Contrarian investing involves going against the prevailing market sentiment. By taking a contrarian approach, you can identify undervalued properties or markets that may offer attractive investment opportunities. This strategy can provide diversification by exploring less crowded investment options.

5. Rental Property Diversification

Diversifying your rental property portfolio is essential to maintain stability and maximize returns.

Strategies for Diversifying Rental Property Portfolio

To diversify your rental property portfolio, consider implementing strategies such as investing in properties with different rental rates, targeting different tenant demographics, and exploring different rental property types.

Investing in Different Rental Markets

Investing in different rental markets allows you to tap into various economic and demographic factors. For example, investing in both urban and suburban rental markets can provide exposure to different tenant preferences and rental demand drivers.

Exploring Different Rental Property Types

Diversify your rental property portfolio by investing in different property types, such as single-family homes, multifamily properties, or even vacation rentals. Each property type offers unique advantages and can cater to different rental market segments.

6. Investment Strategies and Risk Management

Implementing effective investment strategies and risk management techniques is crucial to maintain stability in your investment property portfolio.

Utilizing Buy and Hold Strategy

The buy and hold strategy involves acquiring properties with the intention of holding them for the long term, benefiting from rental income and potential appreciation. This strategy can provide stability and steady cash flow in your investment property portfolio.

Consideration of Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) offer an alternative investment option for diversification. REITs allow you to invest in a portfolio of properties managed by professionals, providing exposure to various real estate sectors and locations.

Hedging Strategies for Property Investments

Hedging strategies can help manage risks associated with property investments. Techniques such as diversifying across asset classes, utilizing derivatives, or hedging against interest rate fluctuations can protect your investment property portfolio from adverse market conditions.

7. Alternative Real Estate Investments

Exploring alternative real estate investments can offer additional diversification opportunities in your investment property portfolio.

Introduction to REITs and Real Estate Crowdfunding

REITs and real estate crowdfunding platforms provide opportunities to invest in real estate projects with smaller capital requirements. These alternative investment options can add diversification to your portfolio and provide exposure to different types of properties and markets.

Investing in Real Estate Mutual Funds

Real estate mutual funds pool investor funds to invest in a diversified portfolio of properties. Investing in real estate mutual funds can enable access to professional management and a broad range of real estate assets, further diversifying your investment property portfolio.

Exploring Real Estate Exchange-Traded Funds (ETFs)

Real estate exchange-traded funds (ETFs) can provide a diversified exposure to the real estate market. ETFs trade on stock exchanges and track a specific real estate index, offering a convenient and liquid way to include real estate investments in your portfolio.

8. Retirement Account Investments

Including real estate investments in your retirement accounts can offer a tax-advantaged way to diversify your investment property portfolio.

Benefits of Investing in Real Estate with Retirement Accounts

Investing in real estate with retirement accounts, such as Self-Directed IRAs or 401(k)s, can provide tax advantages and potentially higher returns compared to traditional retirement investments. Real estate investment diversification within retirement accounts can enhance long-term financial stability.

Self-Directed IRA and Other Account Options

Self-Directed IRAs allow investors to direct their retirement funds towards a broader range of investment options, including real estate. Other account options, such as Solo 401(k)s, also offer flexibility in investing retirement funds into real estate assets.

Rules and Limitations of Real Estate Investment in Retirement Accounts

Investing in real estate within retirement accounts has specific rules and limitations that investors should be aware of. Understanding the contribution limits, prohibited transactions, and required custodianship for self-directed retirement accounts is crucial for successful real estate investment within these accounts.

9. Professional Guidance and Expert Advice

Seeking professional guidance and expert advice is essential when diversifying your investment property portfolio.

Importance of Professional Consultation

Real estate professionals, such as investment advisors, property managers, and real estate agents, can provide valuable insights into different property markets, investment strategies, and risk management techniques. Their expertise can help you make informed decisions and optimize your investment property portfolio.

Hiring a Real Estate Investment Advisor

A real estate investment advisor specializes in helping investors diversify their portfolios and navigate the complexities of the real estate market. They can provide personalized advice, conduct market research, and assist in identifying suitable investment opportunities based on your goals and risk appetite.

Role of a Property Management Company

A property management company can play a crucial role in managing your investment property portfolio. They handle rental collections, property maintenance, tenant screening, and other administrative tasks, ensuring a smooth operation and maximizing returns on your investments.

In conclusion, diversifying your investment property portfolio is essential for stability and maximizing returns. By exploring different property types, geographical locations, rental markets, investment strategies, and alternative options, you can mitigate risks and enhance the stability of your portfolio. Seeking professional guidance and expert advice can further optimize your investment property portfolio for long-term success. Remember, the key to successful diversification is careful consideration, research, and a well-thought-out strategy tailored to your investment goals and risk tolerance.

RELATED POSTS

View all